Understanding IFTA-105: A Comprehensive Guide to Final Fuel Use Tax Rate and Rate Code Table 1

BlogTable of Contents

- Ifta Tax Rates - Fill Online, Printable, Fillable, Blank | pdfFiller

- ifta fuel tax rates| what is ifta tax| ifta quarters| ifta login| ifta ...

- Fillable Online Form IFTA-105:9/04: IFTA Final Fuel Use Tax Rate and ...

- 2nd Quarter 2025 Ifta Fuel Tax Rates - Josefina Taylor

- Fillable Online Form IFTA-105 IFTA Final Fuel Use Tax Rate and Rate ...

- Fillable Online Form IFTA-105 IFTA Final Fuel Use Tax Rate and Rate ...

- Ifta Reporting 2021-2025 Form - Fill Out and Sign Printable PDF ...

- Tax Filing Calendar 2025 Usa - Chloe Poole

- 3rd Quarter IFTA Tax Rate Changes | ExpressIFTA - YouTube

- Fillable Online Form IFTA-105. IFTA 105 4th quarter table 1 Fax Email ...

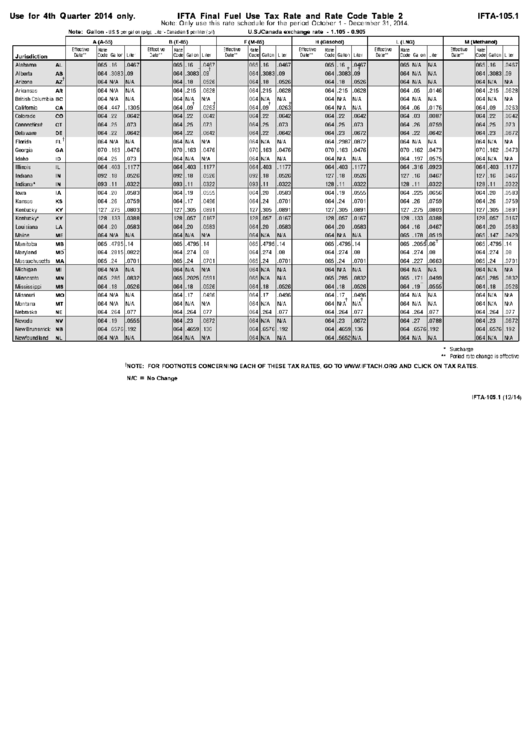

What is IFTA-105?

Importance of Final Fuel Use Tax Rate and Rate Code Table 1

How to Use the IFTA-105 Form and Table 1

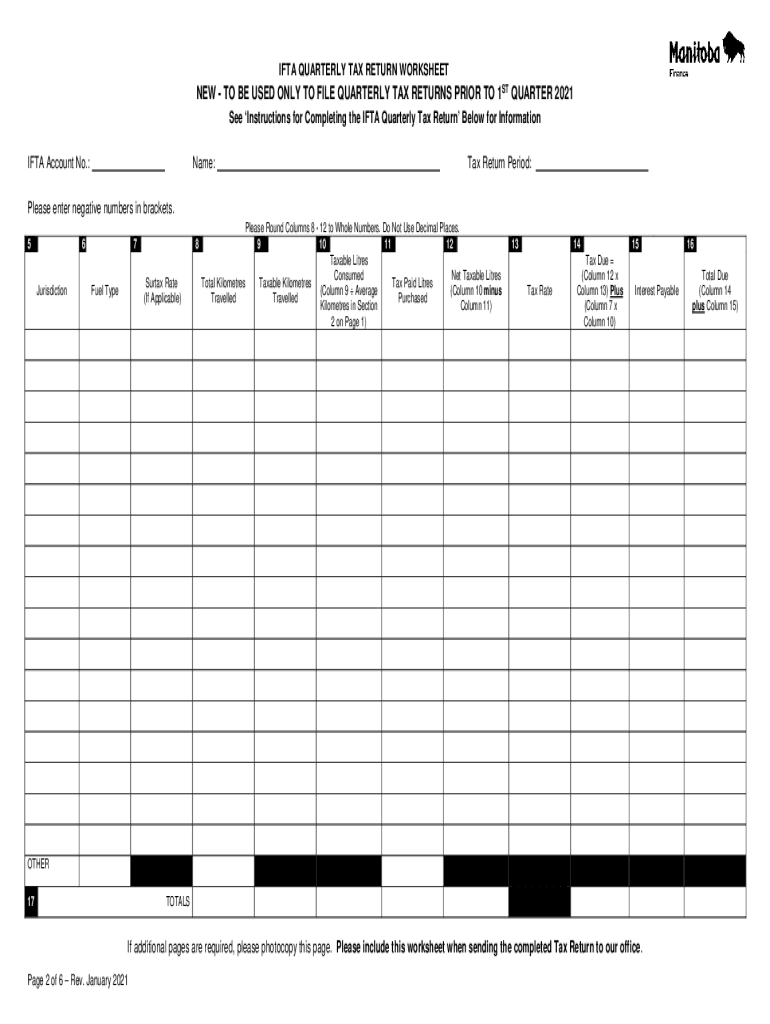

To accurately complete the IFTA-105 form and utilize Table 1, carriers should follow these steps: 1. Determine Jurisdictions: Identify all jurisdictions (states or provinces) where fuel was consumed. 2. Gather Fuel and Distance Records: Collect detailed records of fuel purchased and distance traveled in each jurisdiction. 3. Reference Table 1: Use the Final Fuel Use Tax Rate and Rate Code Table 1 to find the applicable tax rate for each jurisdiction. 4. Calculate Taxes: Calculate the fuel use tax owed or refund due for each jurisdiction based on the tax rates and your fuel consumption. 5. Complete the IFTA-105 Form: Fill out the IFTA-105 form with the calculated taxes, ensuring to include all required information. The PDF Form IFTA-105, particularly the Final Fuel Use Tax Rate and Rate Code Table 1, is a critical tool for motor carriers operating under the IFTA. By understanding how to use this form and table, carriers can accurately calculate their fuel use taxes, ensuring compliance with IFTA regulations and avoiding potential penalties. Regular updates to the tax rates and codes in Table 1 underscore the importance of staying informed about changes in fuel tax laws across different jurisdictions. For carriers, navigating the complexities of fuel use taxation becomes more manageable with a comprehensive guide to the IFTA-105 form and its components.By following the guidelines and understanding the intricacies of the IFTA-105 form and the Final Fuel Use Tax Rate and Rate Code Table 1, motor carriers can streamline their tax reporting process, reduce errors, and focus on their core operations. The accurate completion of the IFTA-105 form is not just a regulatory requirement but also a strategic business practice that can impact a carrier's bottom line. As the transportation industry continues to evolve, the importance of precise fuel tax management will only continue to grow, making the IFTA-105 form and Table 1 indispensable resources for carriers aiming to operate efficiently and compliantly.